We Make Tax Filing A Breeze

Home » IRS Reopens Voluntary Disclosure Program For Errant Employee Retention Credit Claims

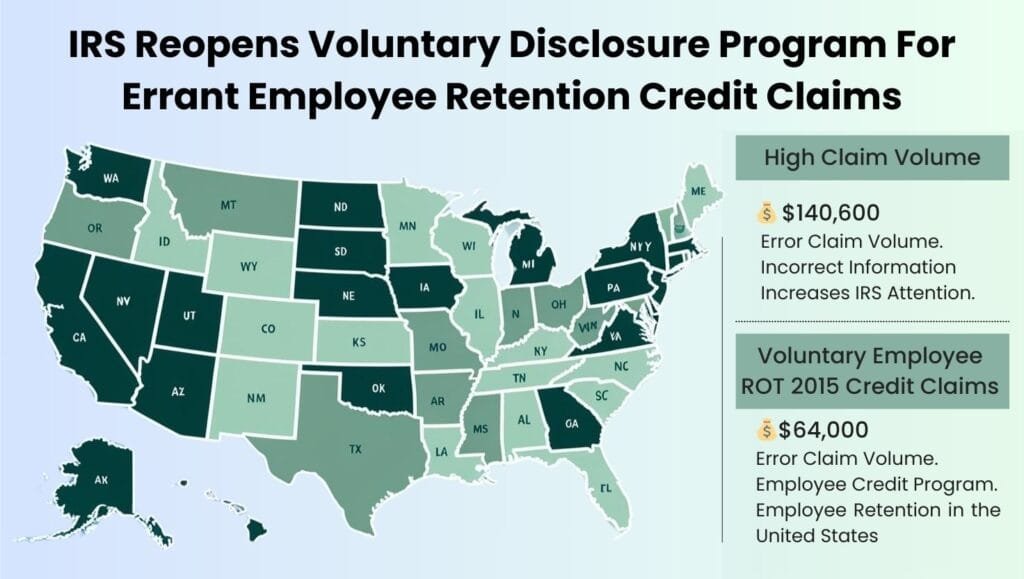

The Internal Revenue Service (IRS) has announced a limited-time reopening of its Voluntary Disclosure Program to help businesses rectify incorrect Employee Retention Credit (ERC) claims. This initiative comes as the IRS intensifies its compliance efforts to address over $1 billion in erroneous claims.

The ERC Voluntary Disclosure Program, available until November 22, offers businesses a chance to correct improper payments at a 15% discount and avoid future audits, penalties, and interest. This follows a successful first program that resulted in over 2,600 applications and the disclosure of $1.09 billion in questionable credits.

To emphasize the importance of participating in the program, the IRS plans to send up to 30,000 letters to address potentially more than $1 billion in improper ERC claims. Thousands more mailings will be sent in the fall to target additional questionable payments.

IRS Commissioner Danny Werfel urged businesses with incorrect claims to take advantage of this opportunity: “The reopening of the Voluntary Disclosure Program provides a final window of opportunity for those misled businesses to make adjustments and avoid future compliance action by the IRS.” He highlighted the aggressive marketing tactics employed by some promoters that led to a surge in questionable claims, clogging the IRS system and slowing down legitimate processing.

In addition to the reopened program, the IRS has taken several other steps to address ERC claims, including:

The ERC was a federal tax credit designed to help businesses keep employees on payroll during the COVID-19 pandemic. Businesses that qualified for the credit could receive up to $5,000 per employee per quarter in tax credits. However, the program was subject to a number of eligibility requirements, and many businesses may have claimed the credit incorrectly.

Some common mistakes made by businesses when claiming the ERC include:

Businesses that have claimed the ERC incorrectly may face a number of consequences, including:

To avoid making mistakes when claiming the ERC, businesses should:

By taking advantage of the reopened Voluntary Disclosure Program and addressing any errors in their ERC claims, businesses can protect themselves from costly compliance actions and ensure their compliance with IRS regulations.

The IRS is sending a clear message to businesses that have improperly claimed the ERC: the days of easy money are over. By taking a more aggressive approach to enforcement, the IRS aims to recover billions of dollars in lost revenue and deter future fraudulent claims. Businesses that have received erroneous ERC payments should take advantage of the voluntary disclosure program or face the consequences of IRS scrutiny.

To learn more about how you can reduce your taxes and save money, check out the helpful resources on our blog or contact us today to schedule a consultation.