We Make Tax Filing A Breeze

Home » Passive vs. Active Rental Income: Understanding IRS Rules and Tax Implications

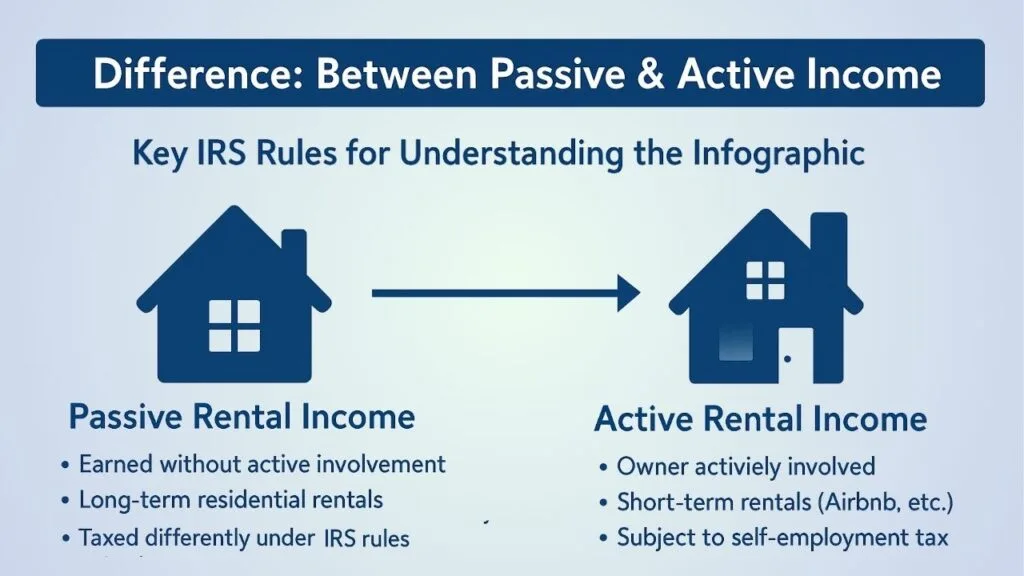

Investing in US real estate can be a rewarding venture, whether you’re based internationally or a US expatriate managing properties from afar. A crucial aspect of this investment journey involves understanding how the Internal Revenue Service (IRS) classifies your rental income: is it active or passive? This distinction isn’t just a technicality; it fundamentally impacts your US tax obligations, particularly the amount of tax owed and how losses can be utilized.

This post will clarify the difference between active and passive rental income according to IRS guidelines, explore the exceptions to the general rule, and explain why correct classification is vital for tax planning and compliance.

In the broader context of real estate business activities, the IRS often distinguishes based on the level and nature of involvement:

It might seem counterintuitive, especially if you spend considerable time managing your rental property – screening tenants, arranging repairs, reviewing finances, even if using a property manager. These activities certainly feel active.

However, the IRS has specific rules for rental activities. According to IRS Publication 925, Passive Activity and At-Risk Rules, rental activities are generally treated as passive activities by definition, even if you materially participate in them. The core idea is that income derived primarily from renting out property for tenants’ use is considered passive.

So, for most individuals owning residential or commercial rental properties and collecting rent, the income generated will be classified as passive for tax purposes, regardless of the time spent overseeing the investment.

While the default classification is passive, certain situations can cause rental income to be treated as active. Understanding these exceptions is critical:

This is perhaps the most significant exception. You might qualify as a “real estate professional” for tax purposes if you meet both of the following conditions:

Crucially, even if you meet these criteria, your rental activities are still considered passive unless you also materially participate in the rental activity itself. Proving material participation often involves detailed record-keeping of hours spent.

If the average period of customer use for your property is 7 days or less, the activity might not be treated as a rental activity under passive activity rules. Income from such short-term rentals (like many vacation rentals) could potentially be classified as active business income, especially if significant services are provided to occupants.

If you use the dwelling unit as a personal residence for more than the greater of 14 days or 10% of the total days it’s rented out at fair market value, specific rules apply which might affect the passive/active determination and limit deductible expenses.

If you rent property to a partnership, LLC, S-corp, or C-corp in which you materially participate, the net rental income might be reclassified from passive to nonpassive (active).

Determining if an exception applies requires careful analysis of your specific circumstances against IRS guidelines.

The classification directly impacts two major areas:

This is a critical implication. The PAL rules generally state that:

Any unused passive losses are generally suspended and carried forward to future tax years. They can then be used to offset future passive income or deducted in full when the entire interest in the passive activity is disposed of in a taxable transaction. (A limited exception allows some individuals with modified adjusted gross income below certain thresholds to deduct up to $25,000 of rental real estate losses against nonpassive income if they actively participate, but this has specific requirements.)

Whether active or passive, you must report rental income. Here’s a simplified breakdown for calculating taxable passive rental income:

Assume you own a residential rental property:

This $2,727 would be subject to ordinary income tax rates based on your overall tax bracket.

If your calculations result in a net loss for tax purposes (e.g., high expenses, vacancy, significant depreciation), remember the PAL rules. If this is your only passive activity, or your other passive activities also show losses, this rental loss generally cannot offset your salary or other active income.

Instead, the loss is typically suspended and carried forward. It can then offset passive income in future years or potentially be deducted when you sell the property.

Rental income and expenses are typically reported on Schedule E (Form 1040), Supplemental Income and Loss. This form is attached to your main US federal income tax return (Form 1040 or 1040-NR for non-residents).

Properly calculating expenses, depreciation, and applying the passive activity rules is essential for accurate reporting. Maintaining meticulous records of income, expenses, and time spent on activities (especially if claiming real estate professional status) is vital.

Understanding whether your rental income is active or passive is fundamental to correct US tax reporting and planning. The general rule treats most rental income as passive, but exceptions based on professional status, rental duration, personal use, and relationship with the tenant (if it’s your own business) can change this classification. The consequences impact self-employment taxes and your ability to deduct losses.

Navigating these intricate rules, especially concerning material participation, real estate professional qualifications, and the Passive Activity Loss limitations, can be challenging for property investors, particularly those managing properties from abroad or dealing with US tax obligations as an expatriate. Ensuring accurate calculation and reporting on forms like Schedule E is crucial for compliance. Professional tax services, like those offered by TheTaxBooks, specializing in US taxation for businesses and individuals (including non-residents and expats), can provide essential clarity and support to ensure you meet your obligations correctly.

To learn more about how you can reduce your taxes and save money, check out the helpful resources on our blog or contact us today to schedule a consultation.