Don’t Miss Your California LLC Statement of Information Deadline!

Keeping your California LLC in good standing is crucial for maintaining its legal status and

Fast, reliable and stress free tax return filing

Federal and State Filing Tax Filing, ITIN Application, Form 5471 Filing, FBAR and FATCA Reporting.

Tax Laws are so complicated and confusing even to file a simple tax return. You may miss many of the deductions and credits that you are entitled to.

The ITIN number is issued by the IRS, for certain resident and non-resident individuals who are required to have an identification.

Certain U.S. individuals who own an interest in a foreign company may be required to report their interest to the IRS by including Form 5471.

The Foreign Bank Account Report, or FBAR, is a filing requirement for U.S. citizens; U.S. residents; entities, including.

Our mission is to add value to both individuals and small businesses with highest-quality tax, accounting services, which contributes to your success. Our goal is to succeed on your success.

Our vision is to be Accounting and Tax firm of choice globally. We will strive for continual growth based upon a reputation of excellence derived from proven results.

We value innovative, timely, efficient, solution-oriented, and cost-effective services and systems. We are committed to achieving the highest levels of customer satisfaction. We provide leadership to the community in delivering proactive bookkeeping and tax services that encompass sound financial controls and the effective and efficient use of University resources.

We prioritize quick and timely delivery of services

Our commitment to excellence ensures the best quality services in the industry.

Regardless of size and complexity, we offer flexible and cost-effective solutions tailored to your needs.

Benefit from our highly experienced professionals who excel in various areas, ensuring a smooth and successful process for your business needs.

Our meticulous approach ensures litigation-free tax filings, compliance, and error-free experiences for stress-free tax returns and bookkeeping services.

Trust TheTaxBooks for industry-leading quality and exceptional customer satisfaction.

15th April 2024 is the dead line for filing taxes for the year 2023.

You can get 6 months for filing tax returns i.e., till 15th October 2024, and should apply before 15th April 2024.

Important note is that the extension is only for filing the tax returns and not for paying the tax. If tax is not paid interest and penalties may apply.

15th June 2024 is the dead line for taxpayers living abroad (Expats).

You will be issued Schedule K-1 when you are any member or partner in any of the LLP/LLC or S-Corp to be included in your personal tax returns.

When there is a delay in getting Schedule K-1 from the LLC/LLP, it’s better to apply extension and file your tax returns after getting Schedule K-1.

If you file your taxes without including Schedule K-1, you need to amend your tax return to include Schedule K-1 when issued.

Keeping your California LLC in good standing is crucial for maintaining its legal status and

Washington, D.C. (August 15, 2024) The Internal Revenue Service (IRS) has announced a limited-time reopening

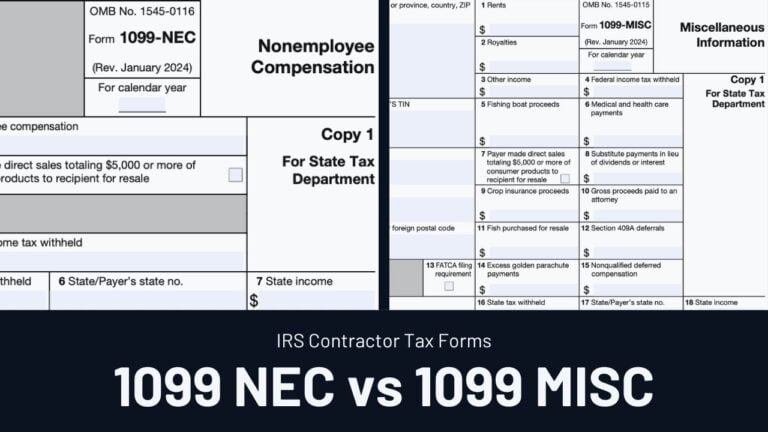

This revised article provides a clear and professional explanation of the 1099 NEC and 1099