US Navigating Form 5472: The Essential IRS Filing for Foreign-Owned US Businesses

As an international entrepreneur or business looking to establish a presence in the United States,

As an international entrepreneur or business looking to establish a presence in the United States,

The United States represents a global standard for business and innovation. For entrepreneurs and established

The reporting landscape for digital payments has finally settled. In a significant administrative move welcomed

The US tax landscape for Americans living abroad often described as complex, costly, and anomalous

The world of international taxation is constantly shifting, but few legislative proposals have created as

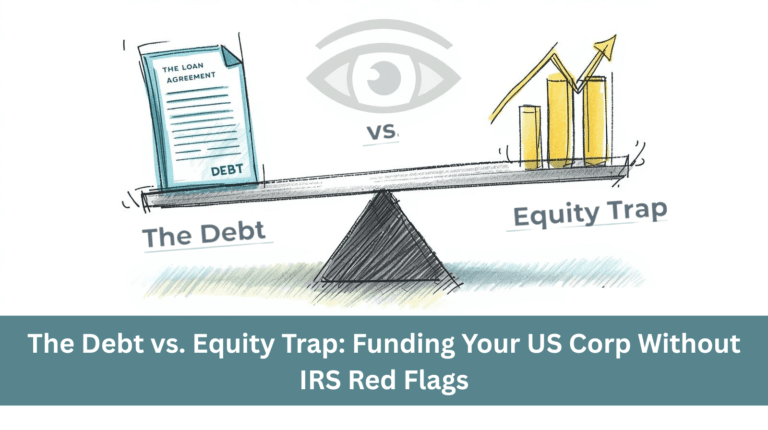

If you’re an international founder establishing a US corporation be it a C-Corp or S-Corp

For many Americans living and building wealth overseas whether in bustling economic hubs or quieter

You’ve worked hard to get to this point. The dream of becoming a U.S. citizen

For non-US citizens and non-Green Card holders, the Substantial Presence Test is the definitive and

With 15+ years of experience in US taxation for individuals and corporations, I offer unique insights due to my 8 years of experience in finance, accounts, and taxation in India. I'm committed to delivering exceptional results in all aspects of my work, from tax compliance to business incorporation. Let me help you navigate the complexities of US taxation.