We Make Tax Filing A Breeze

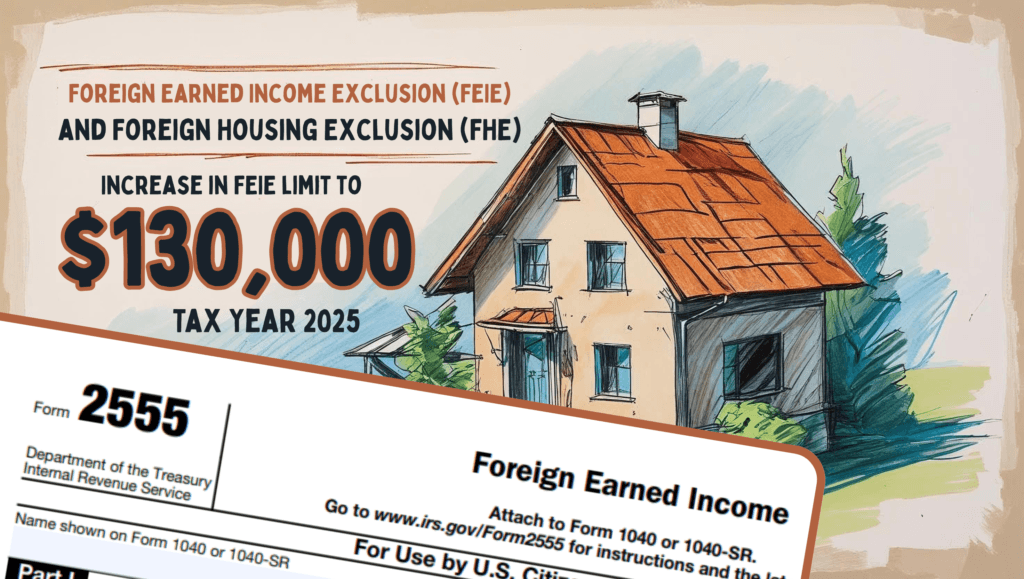

Home » Big News for US Expats: 2025 FEIE Limit Jumps to $130,000!

Living and working abroad as a U.S. citizen definitely comes with its own unique set of challenges and let’s be honest, taxes are usually right up there at the top of the list. But hey, we’ve got some genuinely good news that should make your life just a little bit easier. The IRS recently dropped its inflation-adjusted numbers for the 2025 tax year, and honestly, it’s a pretty sweet deal for us expats.

Ready for it? For 2025 (that’s the taxes you’ll actually file in 2026), the Foreign Earned Income Exclusion (FEIE) limit is shooting up to a cool $130,000! That’s a really nice bump from the $126,500 limit we saw in 2024.

So, what does this actually mean for you? It simply means you can shield even more of your hard-earned foreign income from Uncle Sam’s tax bill, ultimately putting more money right back into your pocket. Let’s dig into the nitty-gritty of what this benefit is all about.

As you probably already know (and maybe even dread!), the U.S. taxes its citizens on their worldwide income, no matter where they call home. This can, of course, lead to the headache of potential double taxation. That’s where the FEIE steps in – it’s a super important tax benefit specifically designed to lighten that load for you.

To put it simply, it allows you to exclude a significant chunk of your foreign salary or business income from your U.S. income tax calculation. For the 2025 tax year, as we just mentioned, you can exclude up to $130,000 per person. Pretty great, right?

Just a quick heads-up: this exclusion applies only to earned income. We’re talking about things like:

It won’t apply to passive income, unfortunately. So, think interest, dividends, capital gains, rental income, or pensions – those are generally still on the U.S. tax radar.

Now, you can’t just wave a magic wand and claim the FEIE. The IRS, bless their hearts, has a few specific requirements you need to meet. It all kicks off with the Tax Home Test, and from there, you’ll need to successfully pass either the Bona Fide Residence Test or the Physical Presence Test.

First things first: your “tax home” needs to be located in a foreign country for the entire qualifying period. Don’t overthink this one your tax home is essentially your main place of business or your work post. It doesn’t necessarily have to be where your family lives or where you feel most “at home.”

This test is all about proving you’re truly a legitimate resident of a foreign country (or maybe even a couple of countries if you’re really globe-trotting!) for a full, uninterrupted tax year. The IRS will look at various factors to figure out if you’re a “bona fide” resident, such as how long you’ve been there, whether you’ve integrated into the local community, and if you genuinely intend to stay abroad for the foreseeable future. They want to see real roots, not just a fleeting visit.

This one’s usually a bit simpler and, honestly, it’s all about counting days. To clear this hurdle, you just need to be physically present in a foreign country for at least 330 full days during any 12-month period. Good news: those days don’t even have to be consecutive, so don’t worry about staying put in one spot for a whole year!

As if the FEIE wasn’t enough, there’s another fantastic tool you can use to reduce your tax burden: the Foreign Housing Exclusion (FHE). This one is specifically designed to help ease the burden of the often-high housing costs that come with living abroad.

Think of it as a dynamic duo with the FEIE – they really complement each other! The FHE helps you cover a good portion of your reasonable housing expenses, things like:

The FHE calculation is based on your actual housing costs, minus a base amount that the IRS sets. And here’s the cool part: since that base amount is actually tied to the FEIE limit, this 2025 increase means you’ll likely be able to exclude even more of your housing costs. More money for adventures, perhaps?

So, let’s talk real numbers. What does this FEIE jump from $126,500 to $130,000 actually mean for your wallet? That’s an extra $3,500 of your income you can potentially shield from the IRS. That’s not small change!

While your exact savings will obviously depend on your individual tax bracket, it truly offers a fantastic bit of financial relief for hardworking expats like you. And when you factor in the FHE on top, your total tax savings for 2025 could be genuinely significant.

These tax breaks are absolutely amazing, but let’s be real, the rules can get a little tricky. Here are a few critical pointers to keep firmly in your back pocket:

Honestly, figuring out the absolute best path forward whether it’s the FEIE, FHE, or the Foreign Tax Credit can get complicated fast. This is precisely where getting some expert professional advice on U.S. expat tax matters can truly make a world of difference in staying compliant and saving you a significant chunk of change.

The higher 2025 FEIE limit is, without a doubt, genuinely great news for Americans living abroad. To really take full advantage of it, it’s super smart to start thinking about it now. Make sure you keep excellent records of your income, your housing bills, and especially your travel dates.

By taking the time to understand how these benefits work and getting your ducks in a row early, you’ll put yourself in a fantastic position to lower your U.S. tax bill and enjoy that expat life a little more.

To learn more about how you can reduce your taxes and save money, check out the helpful resources on our blog or contact us today to schedule a consultation.