We Make Tax Filing A Breeze

Home » Form 8938 and Form 8621: 4 Key Differences to Avoid Filing Mistakes

Living abroad offers an exciting opportunity to explore new places and cultures. Whether you are pursuing your profession in London or running a spa in Thailand, it’s crucial to fulfill your tax obligations in the U.S., even while earning income overseas.

Filing taxes as an American expatriate can be confusing and challenging. Understanding the correct forms to use and how to accurately complete them is as important as knowing how to file your taxes. Two essential forms for expat taxes are Form 8938 and Form 8621.

While both forms require the disclosure of overseas income, they have distinct differences and guidelines. Making errors in completing these forms or failing to file them can result in wasted time and financial penalties. This article will provide a comprehensive overview of Forms 8938 and 8621, equipping you with the knowledge necessary for successful filing.

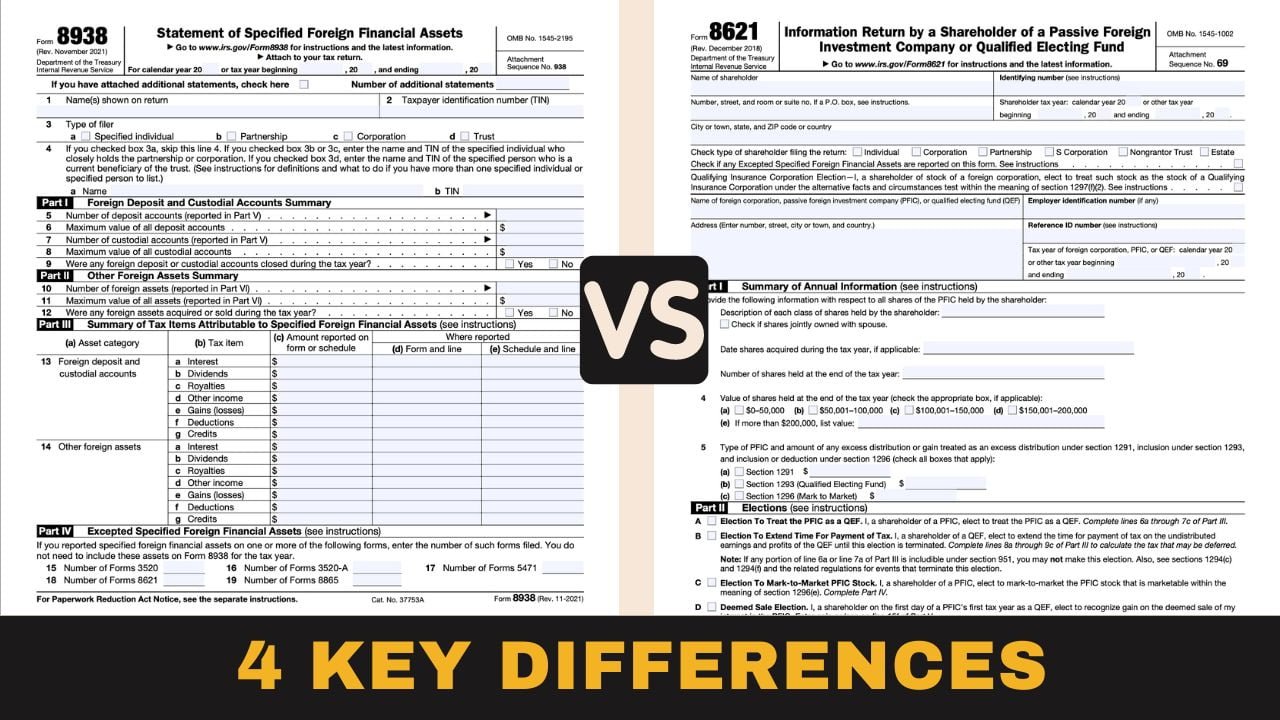

Form 8938, officially known as the Statement of Specified Foreign Financial Assets, is used by expatriates to report their foreign financial assets to the IRS. This includes assets such as shares in foreign companies or foreign pension plans.

This form falls under the Foreign Account Tax Compliance Act (FATCA), a law signed by President Barack Obama on March 18, 2010. FATCA aims to prevent government revenue losses due to non-compliance with foreign asset taxation.

Individual taxpayers whose cumulative value of foreign assets exceeds a specified threshold must comply with this reporting requirement. Taxpayers must report the relevant information on Form 8938 and attach it to their annual income tax return.

Expatriate taxpayers use Form 8621 to report income from Passive Foreign Investment Companies (PFICs) or foreign mutual funds. This form, officially titled “Information Return by a Shareholder of a Passive Foreign Investment Company,” is specifically designed for PFIC reporting.

Under U.S. tax law, mutual funds acquired overseas are considered or structured as corporations. Other entities classified as PFICs include investment trusts, ETFs, and any collective investment registered outside the U.S.

To ensure accurate completion of Form 8621, it is advisable to seek the assistance of a reliable tax resolution services company. While filing online is convenient, the form itself can be intricate and detailed. IRS guidelines require the filing of a form for each PFIC investment, meaning that if your offshore portfolio includes four funds, you will need to file four Form 8621s.

In some situations, forms 8938 and 8621 may go hand in hand, but they are not interchangeable. If you are required to submit a Form 8621 based on your source of income, you will need to accompany it with Form 8938. They share the same goal of reporting foreign assets, but they also have their differences.

Form 8938, under FATCA, is designed to combat global tax evasion by requiring the disclosure of assets held in foreign accounts and other offshore assets. It focuses on a wide range of foreign financial assets. On the other hand, Form 8621 specifically targets income from Passive Foreign Investment Companies (PFICs) or foreign mutual funds. It is a more specific reporting requirement for this particular type of investment.

Form 8938 must be filed by resident aliens, some non-resident aliens, and U.S. citizens who meet specific threshold requirements for foreign financial assets. The threshold is $50,000 for single individuals or married couples filing separately. Married individuals filing jointly have different threshold criteria, such as assets exceeding $100,000 on the last day of the tax year or reaching between $75,000 and $150,000 at any point during the tax year. In contrast, Form 8621 is specifically for taxpayers who are direct or indirect PFIC shareholders. It is required if certain criteria, such as meeting a filing threshold of more than $25,000 or receiving PFIC distributions, are met.

Form 8938 requires the reporting of various foreign financial assets, including foreign accounts, partnership interests, private equity funds, private stocks, hedge funds, and other foreign private investment assets. It encompasses a wide range of offshore assets. On the other hand, Form 8621 focuses specifically on income from PFICs or foreign mutual funds. The reporting requirements on Form 8621 depend on the specific elections made by the taxpayer and can be more complex and detailed.

Failure to file Form 8938 can result in penalties, starting at $10,000. Continuing non-compliance after receiving IRS notification can lead to additional fines of up to $50,000. There is also a 40% penalty for underreporting taxes on undisclosed assets. In the case of Form 8621, there is no specific amount mentioned for failure to file. However, the IRS may subject taxpayers to an audit and potentially suspend the statute of limitations on their tax returns.

One similarity that these two forms share is that both are due on the date of your income tax return filing.

Taxes, in general, are already complicated. Dealing with U.S. taxes while living in a foreign land can get even more frustrating. While it is possible to accomplish these forms on your own, getting the help of tax resolution partners can save you the headache of sorting through all the required information.

TheTaxBooks offers the best-in-class service for U.S. expats. They can help you avoid future problems while minimizing your tax liabilities. They can ensure smooth-sailing and hassle-free tax preparation services so you can focus on living your best life abroad.

To learn more about how you can reduce your taxes and save money, check out the helpful resources on our blog or contact us today to schedule a consultation.