Can a Non-US Resident Open a US Business Bank Account?

For international entrepreneurs and businesses looking to tap into the vast US market, establishing a

For international entrepreneurs and businesses looking to tap into the vast US market, establishing a

So, you’ve successfully formed your US company – congratulations! Whether you’re an international entrepreneur establishing

The US tax system offers various credits to help reduce the tax burden on individuals

The shift towards remote work has offered unprecedented flexibility for employees and employers alike. However,

Filing your U.S. individual income tax return (Form 1040) involves choosing between taking the standard

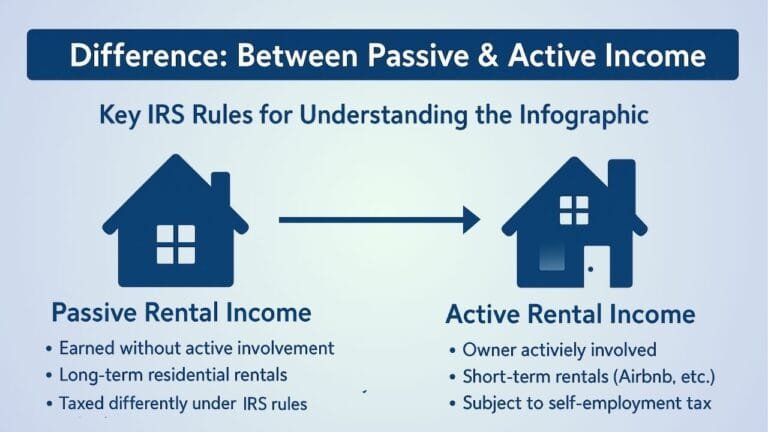

Investing in US real estate can be a rewarding venture, whether you’re based internationally or

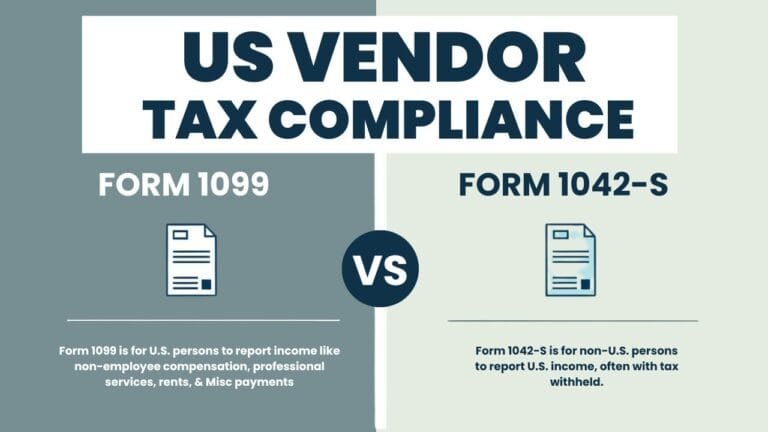

Paying vendors is a routine part of doing business, but ensuring proper tax compliance, especially

Keeping your California LLC in good standing is crucial for maintaining its legal status and

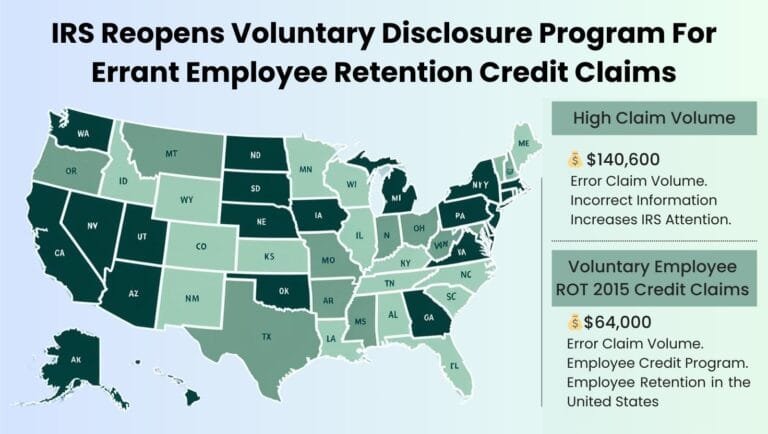

Washington, D.C. (August 15, 2024) The Internal Revenue Service (IRS) has announced a limited-time reopening

With 15+ years of experience in US taxation for individuals and corporations, I offer unique insights due to my 8 years of experience in finance, accounts, and taxation in India. I'm committed to delivering exceptional results in all aspects of my work, from tax compliance to business incorporation. Let me help you navigate the complexities of US taxation.